WTO/FTA@Negotiation

and Recent Trend of Rice Market

---with respect to the implication on rice consumption

level----

Masaru KAGATSUME

Professor,

Graduate

<Contents>

1.

Introduction

(1)Outline of Agricultural

Negotiation Result of the

(2)Shifting into the rice tariffication system in April, 1999

2.

Reform of Rice

Distribution System

3. Situation

of Rice Import & Reserve Stock

4. Determining

Factors of Rice Demand

1. Introduction

(1) Outline of Agricultural Negotiation

Result of the

When GATT Uruguay Round had concluded

in 1994 and the liberalization process started,

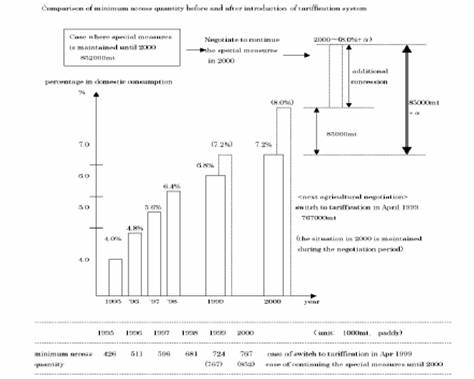

As for minimum access measures, the

government has charges the mark-up through the state trade from the imported

rice. The minimum access quantity was started in 1995 with importation of 4% equivalent of the

domestic consumption in basis period (1986-1988) and this was planned to increase

to 8% equivalent in final year of the agreement 2000. This means rice import

had to be increased every year by 0.8% of base year total consumption. In

volume terms, 379 thousand tons of milled rice was imported in 1995 and this

was planned to increase to import

of 758 thousand tons milled rice in 2000.

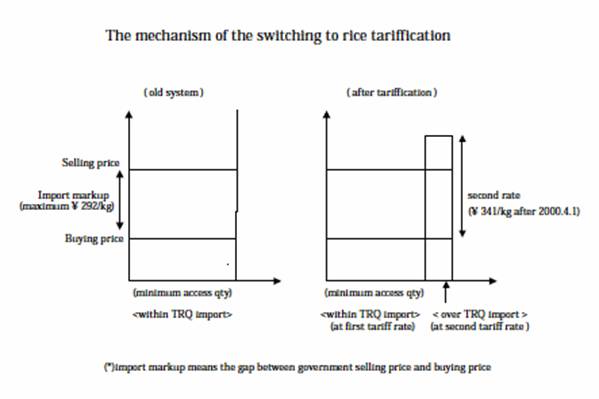

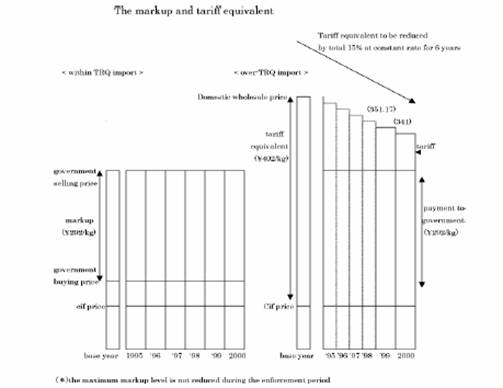

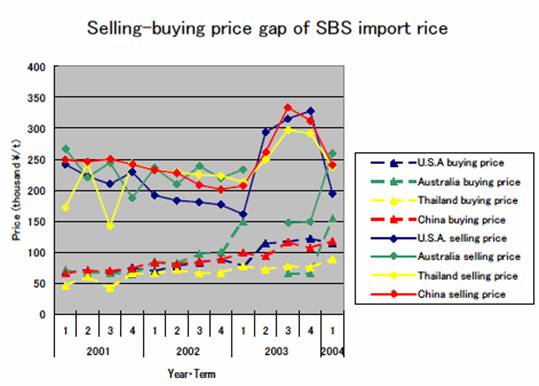

The Mark-up charge was set based on the

gap between selling price and buying price of the imported rice (Thailand Rice)

purchased by the government food agency in the basis period (1986-1988). This

is sort of specific tax of maximum \292/kg.

In addition to these, the simultaneous

buying-selling system (SBS) was introduced in order to establish reasonable

domestic market evaluation of the imported rice following the minimum access.

The same system was applied to the rice processing commodities.

(2) Shifting into the rice tariffication system in April, 1999.

The agreement on tariffication under

Uruguay Round required for the first tariff rate quota ( minimum access ) to be

increased from import of 3 % of domestic consumption in base year to 5% i.e.

0.4% increase per year. But Japan accepted the minimum access option with more

compromised way, i.e, increasing rice import from 4% to 8% of the base year

consumption i.e. 0.8% increase per year. So, after

In 1999, under the old

minimum access system, rice import would be 767 thousand tons ( paddy ) but

under the tariffication system, this would be reduced to 724 thousand tons in paddy base. In milled rice base,

these reduction were from 682 thousand tons to 644 thousand ton in milled rice

base ). As for year 2000, this rice import reduction was from 852 thousand tons

to 767 thousand tons in paddy base. In milled rice base, this rice import

reduction would be from 758 thousand ton to 682 thousand ton in milled rice

base. These changes are summarized in the following way.

a) abolishment of licensing of rice trading.

Licensing system of rice export-import is abolished, following

this, the compulsory selling of rice

imported through permission to government is abolished.

b) implementation of payment to government for rice import.

For rice which is imported under the

second (over quota) tariff rate, the government can charge one part of

second tariff rate as a payment to the government ( \292/kg ).

This

payment to the government from the rice import is appropriated for the imported

food administration account of the staple food administration special

account.

c) implementation of the

notification system on rice import-export.

The rice import-export have to be

notified to the government.

d) setting the second ( over quota ) tariff rate.

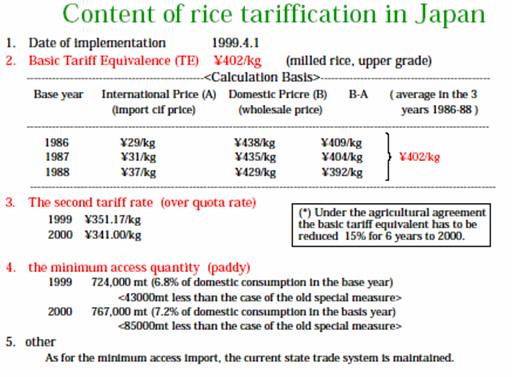

<1> the basic primary

rate( \402/kg ) is set to be tariff equivalent based on the agricultural agreement

<2>

the second ( over quota ) rate is calculated based on the agreement. The rest of the second rate from

which the payment to government is deducted was set to be the preliminary rate.

Second rate

of which, preliminary rate

1999

\351.17/kg

\59.17/kg

2000 \341/kg \49/kg

<3> rice can be protected by the

special emergency tariff system ( special safeguard system)

Figures 1 to 4

show the detailed contents of rice tariffication after 1999 in

Figure 1 Content of rice tarification in

Figure 2 The mechnism of the switching to

tariffication

Figure 3 Comparison of minimum access quantity

before and after tariffication system

Figure 4 Comparison of minimum access quantity

before and after tariffication system

Since the acceptance of rice tariffication,

border protection measures are almost deregulated and very trivial level in

Maybe, this is due to the facts that

until recently

At the time

of negotiation of WTO new round, the chairman of agricultural committee, Mr Harbinson had announced the Modality Proposal. The characteristics

of his proposals are that two measures of tariff peaks and tariff escalation

should be deleted.

2. Reform of Rice

Distribution System

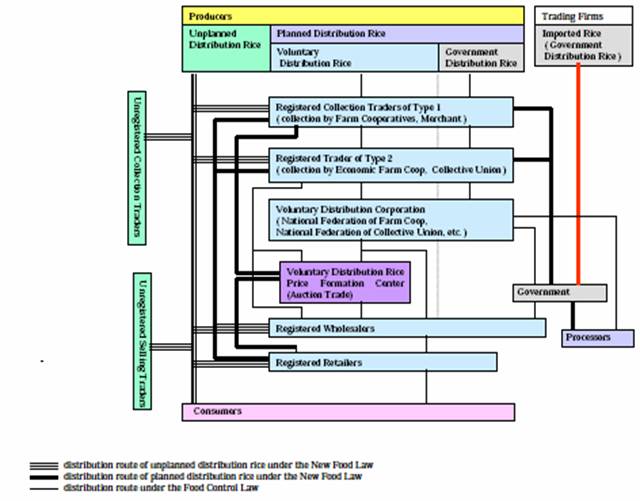

Rice Distribution System

has long been controlled by Food Control Law enacted in 1941. Under the

Food Control Law, Government bought rice at the higher producer price and sold

it to the consumer at the lower consumer price. Which had caused huge budget

deficit and surplus rice. And so, in order to curtail the budget deficit based

on government rice, government began to introduce paddy field diversification

scheme. Also, government introduced

Voluntary Distributed Rice system, where the consumer price was higher

than the producer price in 1969. The weight of this Voluntary Distributed Rice

in total rice market has been expanding and became more dominant part than the

government distribution rice. In addition to these 2 channels of rice market,

the freely (unregistered) distributed rice channel had emerged illegally and

gradually expanded to the similar weight to the government distribution rice

channel and voluntary distribution rice channel. The rice distribution channels

under the Food Control Law has been changed and revised several times. In 1990,

Voluntary Distributed Rice Price Formation Organization was established and

rice prices began to be guided by the market situation of voluntary

distribution rice rather than the government distribution rice.

In 1992, New Agricultural Policy was introduced and following

this, at long last, the food control law was abolished in 1995 when New Food

Law was introduced. Under the New Food Law, new rice distribution system, so

called, the Planned Distributed Rice system was introduced. In this

distribution system, rice prices were expected to be guided by the Planned

Distributed Rice price which was formed by the kind of auction style organized

by rice price formation center. In this system, all of Planned Distributed Rice had to

be traded by the registered market dealers. The rice distribution channels

under the Planned Distributed Rice system are shown in the following Figure 5.

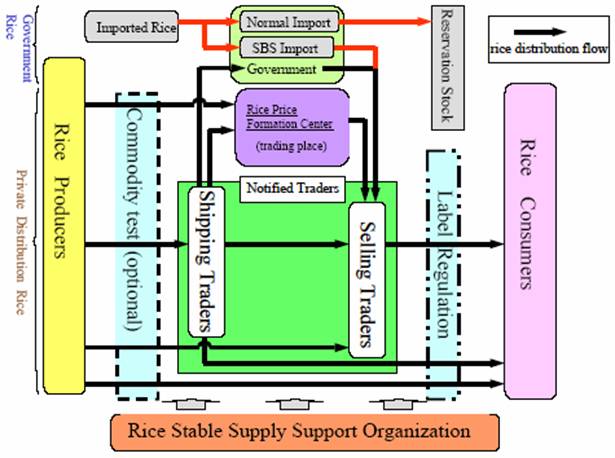

However, the weight of unplanned distributed rice trade has

gradually expanded and so, the price formation system by this center did not

function effectively. So, this

Planned Distributed Rice system was also abolished in April 2004. Since then,

rice distribution channels were totally deregulated and liberalized. Now, rice

can be retailed at convenience stores. This new rice

distribution system is shown in Figure 6.

Figure 5 Rice Distribution Channels under the

Planned Distribution Rice System

Figure 6 Rice Distribution after abolishment of

Planned Distribution Rice System

3.

Situation of Rice

Import and Reserve stock

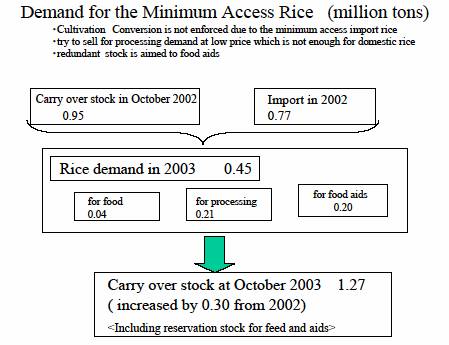

Rice import

situation in 2003 fiscal year was as follows. Under the minimum access system

based on the Uruguay Round Agreement since 1995, rice import has maintained at

the level of 0.77 million tons of paddy, of which SBS rice import was 0.10

million tons.

Moreover, 0.08

million tons of glutinous rice were imported in order to stabilize supply. This

was twice level of the usual year.

All of the 0.10

million tons of SBS imported rice were sold out through auction although only

0.05 million tons ( half of the predicted amounts ) of SBS import rice were

sold in the previous year 2002.

Rice import in 2004 fiscal year was almost similar

to preceding year. Until the new agreement in WTO is realized, the Minimum

Access import is maintained at the same level of 2000 and so, 0.77 million tons

of paddy were imported in 2004. Also, 0.10 million tons of paddy are imported

under the SBS import system through the 4 auctions a year.

The demand for the minimum access rice is shown as following Figure 7.

Figure 7 Demand for the Minimum Access Rice

And reserve stock of rice was accumulated at the level of 1.63

million tons at June 2003, which was exceeding optimal reservation level of 1

million tons. However, this stock decreased to the level of 0.73 million tons

at June 2004 due to strong demand by wholesaler and production declined after

August 2003.

On the other

hand, the rice stock by wholesalers increased to 0.76 million tons at February

2004, increased by 0.43 million tons from preceding year.

As for the rice

reserve tock policy, Japanese government has set optimum stock level

to be 1 million tons. This is planned to be managed by Revolving Reserve stock

method by 0.5 million tons a year and not by Set Aside method

The trading of reserve stock rice would be changed from Arbitrary Negotiation (Direct trading) system to Auction trading (bidding) system

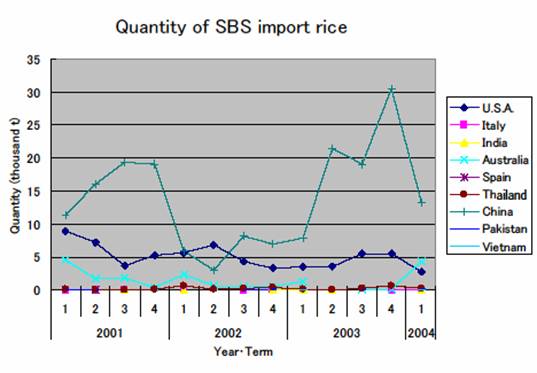

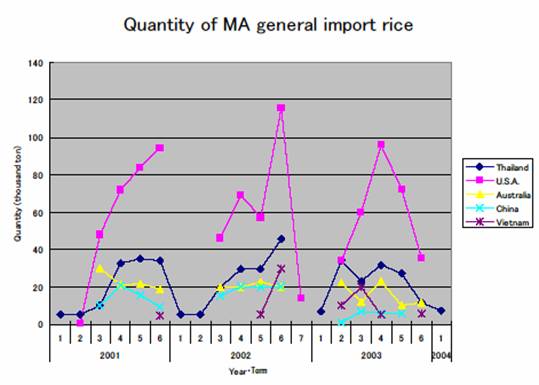

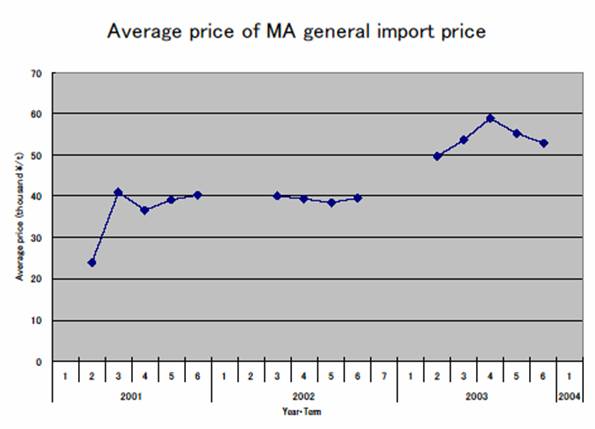

As already explained, rice import is

carried out through the 2 routes.

One is SBS import system and the other is general ( normal ) import. The

recent situations of both import routes are shown in the following figures (

Figures 8 and 9 on SBS import rice and Figures 10 and 11 on MA general import

rice, respectively). In this figure

8, it is shown that as long as SBS import rice is concerned, the share of

.

Figure 8 Quantity of SBS import rice

Figure 9 Selling-Buying price gap of SBS import

rice

Figure 10 Quantity of MA general import rice

Figure 11 Average Price of MA general import rice

4.

Determining Factors

of Rice Consumption Demand

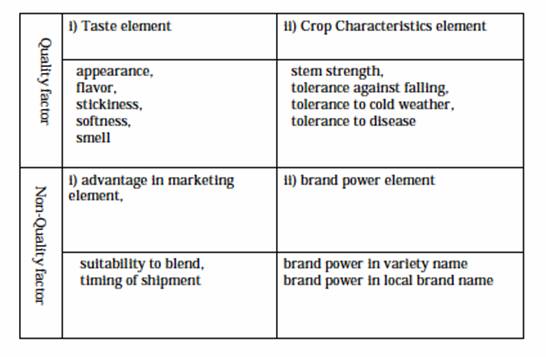

According to

the market behavior theory, factors affecting rice price gaps are categorized

as follows. First of all, these affecting factors are classified into quality

related factors and non quality related factors. The quality related factor

consists of taste element and crop characteristics element. And the non quality

related factor consists of advantage-in-marketing element and brand power

element. The component parts of taste element are appearance, flavor,

stickiness softness and smell. The component parts of crop characteristics

element are stem strength, tolerance against falling, tolerance to cold weather

and disease. The component parts of advantage-in-marketing element are blend

suitability and shipment timing. The component parts of brand power element

consist of brand powers in variety name and in local brand name. Taste element

and brand power element are considered as the consumer side conscious elements.

The crop characteristics elements and advantage-in-marketing element are

considered as the producer or supplier side conscious elements.

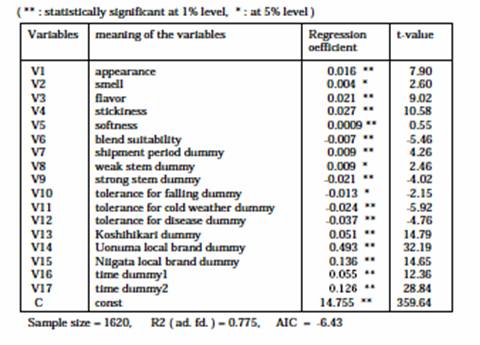

Table 1 Factors affecting on Rice Consumption

Demand and Price

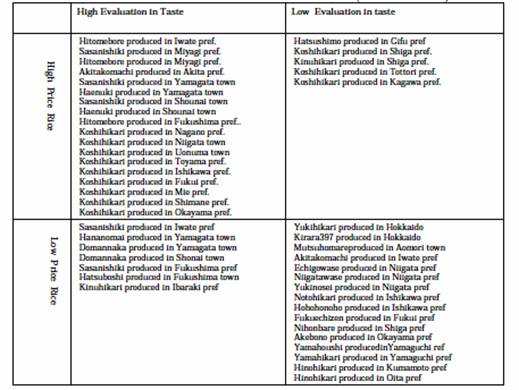

According to the

research results based on the cluster analysis, rice varieties and brands are

categorized into 4 regions formed by combination of dichotomy in their taste

levels and dichotomy in their price levels (Table 1). If rice price are

determined perfectly by its taste evaluation only, all rice varieties and

brands should be located in the diagonal regions, in other word, in the region

of combination of high evaluation in taste and high price rice or combination

of low evaluation in taste and low price rice. However, in

Table 2 Relations between Rice Price and Taste

Evaluation (

In order to confirm these results, the hedonic regression analysis was carried out. Dependent variable is rice price gap and explanatory variables are each elements of rice price affecting factors which were shown in the above Table 1.

According to the results of hedonic regression

approach, the variable of Uonuma local brand dummy has the most significant and

biggest impacts on price gaps between the rice brands classified by the

producing areas. Nextly, the

variable of

The

interesting fact is that the factors of taste element of the rice quality

related factors, such as appearance, flavor, stickiness, softness or smell, did

not show strong impact at all.

Also, crop characteristics elements, such as stem strength, tolerance

against falling, tolerance to cold weather or tolerance to disease, did not

show strong impacts on price gaps among rice varieties and brands (Table 3).

As for the

non-quality related factors such as blend suitability or shipment timing,

they were not significantly affecting on price gap.

Judging from those results, it is pointed out that the most important one among

4 elements of rice price gap determining factors was brand power elements which

consist of brand power in variety name and brand power in local brand name.

Table 3 Results of Hedonic Regression Analysis